- You might have heard the term “budget” before, but what does it really mean? Let’s break it down so you can understand how creating and following it. it can help you manage your money better.

- we’re diving into an essential topic that impacts everyone: budgeting. Whether you’re saving for a new toy, planning a vacation, or managing your family’s finances, understanding how to plan is key to achieving your goals. Let’s explore about it, why it’s crucial, and how you can create and manage one effectively.

Table of Contents

What is a Budget?

A budget is a detailed plan for managing your money. It outlines how much money you earn, how much you spend, and how much you save. This plan helps you balance your income and expenses, allowing you to make informed decisions about your finances.

Here are some common types

| Type of Budget | Purpose |

|---|---|

| Personal | Used by individuals and families to manage their day-to-day finances. |

| Business | Created by businesses to track income and expenses, and plan for future financial needs. |

| Government | Managed by governments to allocate funds for public services and projects. |

- Personal based: Used by individuals and families to manage their day-to-day finances.

- Business based: Created by businesses to track income and expenses, and plan for future financial needs.

- Government based: Managed by governments to allocate funds for public services and projects.

Why is Creating a Budget Important?

1. Balance Your Income and Expenses

A budget helps you keep track of how much money you have coming in and how much you are spending. By comparing these, you can ensure that you are not spending more than you earn. This helps prevent debt and ensures that you are living within your means.

2. Plan for the Future

With a budget, you can plan for future expenses and savings goals. Whether it’s saving for a new gadget, a family vacation, or retirement, having it helps you allocate funds to achieve these goals.

3. Prioritize Your Spending

it help you decide what is most important to spend money on. For instance, you can prioritize essential expenses like housing and food over non-essentials like dining out or entertainment. This way, you ensure that your money is going towards what matters most to you.

4. Save and Invest Wisely

A well-planned budget helps you set aside money for savings and investments. By tracking your income and expenses, you can determine how much you can afford to save each month and invest wisely for your future.

To understand the importance of savings and investments, read our ultimate guide to financial planning.

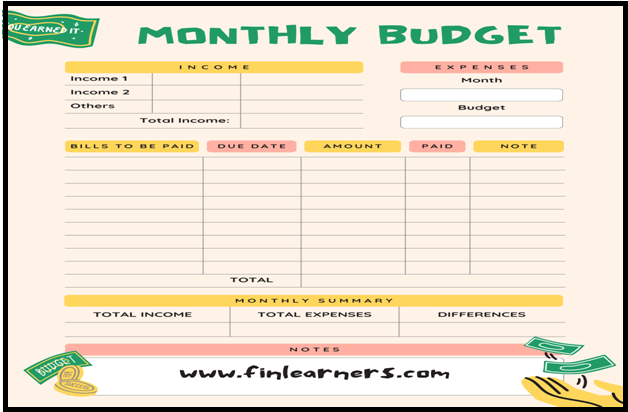

Process

it involves several key steps. Here’s a simple guide to help you get started:

1. Assess Your Income

Begin by listing all sources of income. This includes:

- Salary: Money you earn from your job.

- Investment Returns: Earnings from investments such as stocks or bonds.

- Dividends: Money received from owning shares in a company.

- Other Earnings: Additional income from part-time work, freelance jobs, or side businesses.

For more information on tracking income, visit our income tracking guide.

2. Evaluate Your Expenses

Next, list all your expenses. Divide them into two categories:

- Regular Expenses: These are recurring costs that you pay every month, such as rent or mortgage, utility bills, groceries, and transportation.

- Irregular Expenses: These are occasional or unexpected costs, such as medical bills, car repairs, or holiday gifts.

Understanding your expenses helps you identify areas where you might be able to cut back. Learn more about managing expenses in our expense management tips.

3. Plan for Savings and Investments

After accounting for your expenses, determine how much money is left. Allocate this amount towards savings and investments. Decide how much to set aside for:

- Emergency Savings: Money saved for unexpected expenses or emergencies.

- Retirement Savings: Funds set aside for your retirement.

- Investment Accounts: Money invested in stocks, bonds, or mutual funds to grow over time.

4. Monitor Your Budget

Regularly review it to ensure you’re sticking to it. Track your spending and compare it with your total amounts. If you notice any discrepancies, make adjustments to stay on track.

5. Review and Adjust

Your financial situation can change, so it’s important to review and adjust your budget regularly. If you get a raise, change jobs, or experience a major life event (like moving or having a baby), update it to reflect these changes.

Benefits of Budgeting

it offers numerous benefits:

1. Assess Your Financial Situation

A budget provides a clear view of your financial status. You’ll understand how much you’re earning, spending, and saving. This clarity helps you make better financial decisions.

2. Prioritize Your Spending

Budgets help you identify which expenses are necessary and which are discretionary. By prioritizing essential expenses, you can avoid unnecessary spending and ensure that your money is used effectively.

3. Control Unnecessary Spending

Having a budget helps you keep track of where your money is going. By monitoring your spending, you can avoid impulse purchases and stick to your financial plan.

4. Achieve Your Financial Goals

A well-structured budget guides you towards reaching your financial goals. Whether you’re saving for a vacation, a new car, or retirement, it helps you stay focused and motivated.

5. Reduce Financial Stress

Knowing that you have a plan for your money can reduce financial stress. A budget helps you feel more in control of your finances and less worried about unexpected expenses.

Special Tips for Different Types

Salary-Based

If you get a paycheck every month, making a budget is easy. Use your net salary, which is what you get after taxes. Keep track of how much you earn and spend each month.

Business-Based

For business owners, creating a budget can be more complex. Consider creating:

- Annually: A long-term budgets for the entire year, including projected income and expenses.

- Quarterly: Shorter-term budgets that help you track financial performance throughout the year.

Common Budgeting Mistakes to Avoid

Here are some common mistakes and how to avoid them:

1. Ignoring Small Expenses

Small expenses can add up over time. Be sure to include all your expenses in your budget, no matter how minor they may seem.

2. Not Tracking Your Spending

Creating a budget is only useful if you track your spending. Regularly review your transactions and compare them with your total planned amounts.

3. Setting Unrealistic Goals

Make sure your budget goals are achievable. Setting unrealistic targets can lead to frustration and make it harder to stick to your Goal.

4. Failing to Adjust

Life changes, and so should your budget. Regularly review and adjust it to reflect changes in your income or expenses.

5. Neglecting Savings

Ensure that you includes a portion for savings. Prioritize saving for emergencies, retirement, and other financial goals.

Conclusion

In this guide, we’ve covered what a budget is and why it matters. We also showed how to make and manage one. A good smart plan helps you manage your money, plan for the future, and reach your financial goals.

By following our steps, you can better control your finances. This leads to a more secure financial future.

If you have questions or need help with it, just ask in the comments or email us. We’re ready to assist you on your financial journey!